Welcome Investors

Welcome Investors

INVESTOR RELATIONS HOME

Welcome to our Investor Relations site, where shareholders, investors, and stakeholders can easily access the latest financial updates, stock exchange announcements, corporate governance insights, annual and sustainability reports, and investor news.

Latest News

Latest News

NEWSROOM

Financial Information

Financial Information

FINANCIAL INFORMATION

Stock Information

Stock Information

STOCK INFORMATION

Request for Information

Request for Information

EMAIL ALERTS

Full Year Results Financial Statement And Related Announcement 2022

Financials ArchiveFirst Half Year Results Financial Statement And Related Announcement 2022

Financials ArchiveFull Year Results Financial Statement And Related Announcement 2021

Financials ArchiveFirst Half Year Results Financial Statement And Related Announcement 2021

Financials ArchiveFull Year Results Financial Statement And Related Announcement 2020

Financials ArchiveSecond Quarter Financial Statement And Dividend Announcement 2020

Financials ArchiveFirst Quarter Financial Statement And Related Announcement 2020

Financials ArchiveFull Year Results Financial Statement And Related Announcement 2019

Financials ArchiveThird Quarter Financial Statement And Dividend Announcement 2019

Financials ArchiveSecond Quarter Financial Statement And Dividend Announcement 2019

Financials ArchiveFirst Quarter Financial Statement And Related Announcement 2019

Financials ArchiveFull Year Results Financial Statement And Related Announcement 2018

Financials ArchiveThird Quarter Financial Statement And Dividend Announcement 2018

Financials ArchiveSecond Quarter Financial Statement And Dividend Announcement 2018

Financials ArchiveSecond Quarter Financial Statement And Dividend Announcement 2016

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Unaudited Financial Statements for the Second Quarter and Half Year ended 31 December 2015

Profit & Loss

Balance Sheet

Review Of Performance

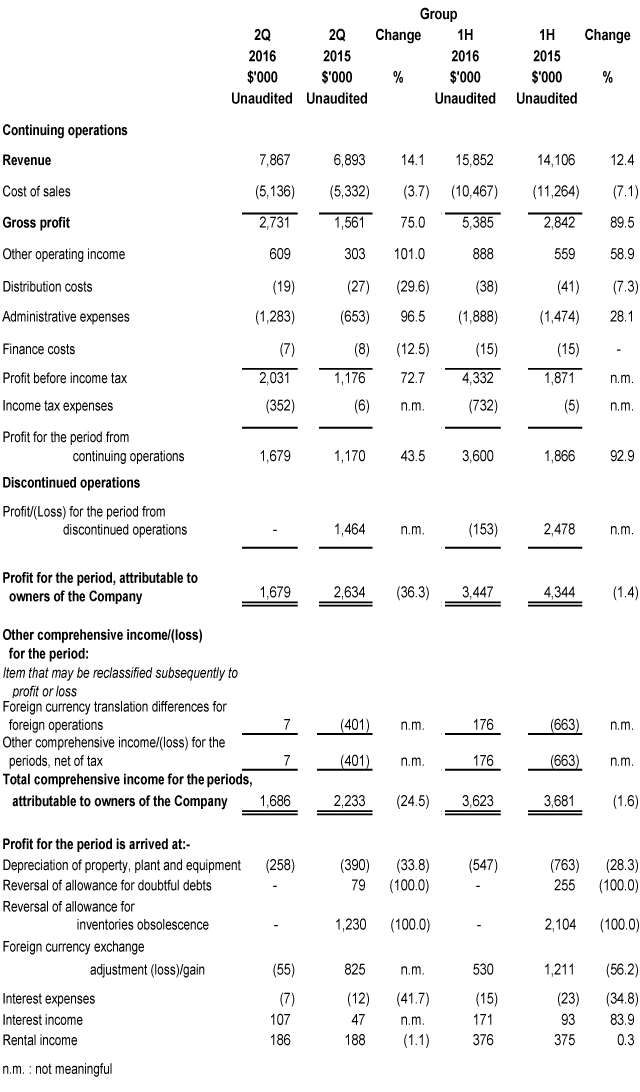

STATEMENT OF COMPREHENSIVE INCOME

Revenue from continuing operations

1H 2016 vs. 1H 2015

In 1H 2016, the Group reported a revenue of $15.9 million, an increase of $1.8 million or 12.4% as compared to 1H 2015 of $14.1 million. The increase in revenue was primarily due to the increase in sales reported by the Engineering Services business segment, which contributed 36.2% to the Group's revenue in 1H2016 as compared to 26.8% in 1H 2015.

2Q 2016 vs. 2Q 2015

In 2Q 2016, the Group reported a revenue of $7.9 million, an increase of $1.0 million or 14.1% as compared to 2Q 2015 of $6.9 million. The increase in revenue was primarily due to the increase in sales reported by the Engineering Services business segment, which contributed 34.8% to the Group's revenue in 2Q2016 as compared to 17.7% in 2Q 2015.

Gross profit from continuing operations

1H 2016 vs. 1H 2015/2Q 2016 vs. 2Q 2015

The Group reported a gross profit of $5.4 million for 1H 2016, an increase of $2.6 million or 89.5% as compared to $2.8 million for 1H 2015. Gross profit margin over that period had also increased from 20.1% in 1H 2015 to 34.0% in 1H 2016.

The Group reported a gross profit of $2.7 million for 2Q 2016, an increase of $1.1 million or 75.0% as compared to $1.6 million for 2Q 2015. Gross profit margin over that period had also increased from 22.6% in 2Q 2015 to 34.7% in 2Q 2016.

The increase in the gross profit margin for the two comparative periods was primarily due to the higher revenue with improved gross profit margin, in addition to the ongoing cost control measures and the enhancement in productivity across all business segments.

Profit for the period

1H 2016 vs. 1H 2015/2Q 2016 vs. 2Q 2015

The Group reported a profit of $3.4 million for 1H 2016 as compared to $4.3 million for 1H 2015 aided with a profit of $1.7 million for 2Q 2016 as compared to $2.6 million for 2Q 2015.

The decrease in profit for the comparative periods was a result of no further gains being registered in the discontinued operations of the US subsidiaries, and foreign exchange rates contributing to higher administration expenses. Nonetheless, the profit for continuing operations had increased in the comparative periods due to the higher revenue and improved gross profit margins across the business segments. Overall, the Group registered a positive profit for the comparative periods.

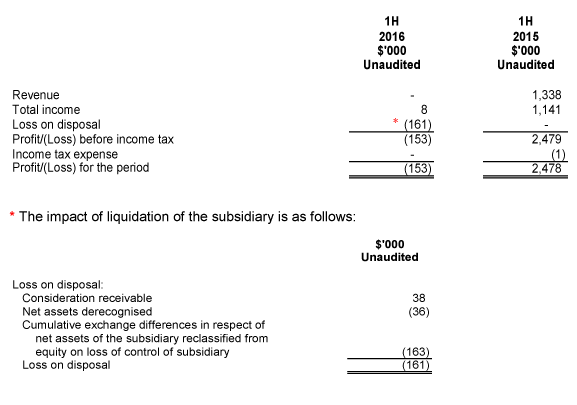

DISCONTINUED OPERATIONS

The voluntary liquidation of the subsidiary, Verde Designs, Inc., was completed in 2Q2016. The impact of liquidation of the subsidiary is recorded under discontinued operations in the statement of comprehensive income.

The results of the discontinued operations in the Imaging Equipment and Energy Efficient Products business segment are as follows:

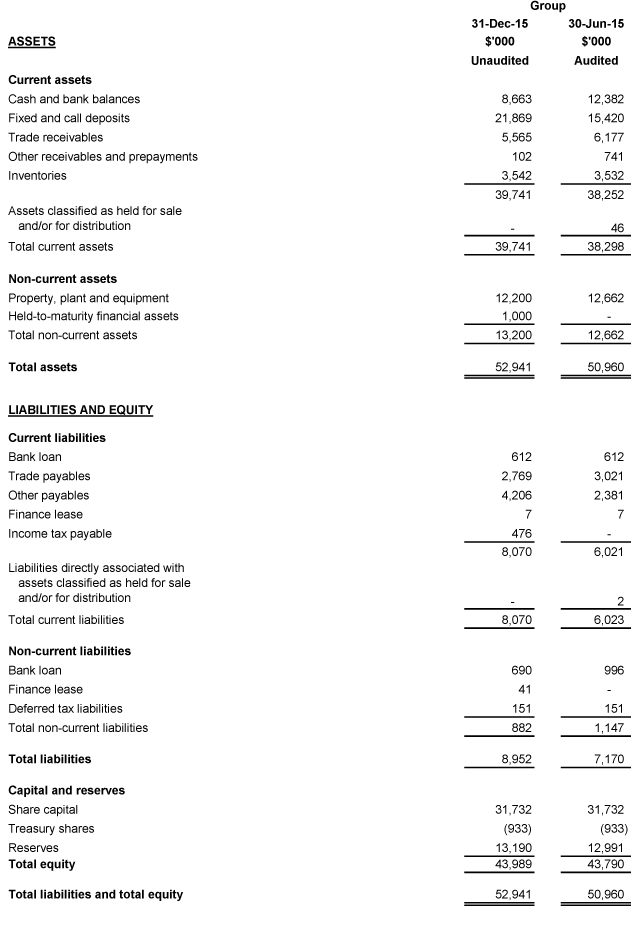

STATEMENT OF FINANCIAL POSITION

Total Group's assets increased by $2.0 million or 3.9% from $51.0 million as at 30 June 2015 to $53.0 million as at 31 December 2015. The increase was primarily due to the increase in fixed and call deposits of $6.4 million and held-to-maturity financial assets of $1.0 million. The overall increase was offset by the decrease in cash and cash balances of $3.8 million, trade and other receivables of $1.3 million as well as property, plant and equipment of $0.4 million.

Total Group's liabilities increased by $1.8 million or 24.9% from $7.2 million as at 30 June 2015 to $9.0 million as at 31 December 2015. The increase was primarily due to the increase in income tax payables of $0.5 million and the dividend payable of $2.4 million. The overall increase was offset by the decrease in trade and other payables as well as repayment of bank loan of $0.8 million and $0.3 million respectively.

The Group had a positive working capital of $31.7 million as at 31 December 2015 as compared with $32.3 million as at 30 June 2015.

STATEMENT OF CASH FLOW

The Group generated net cash from operating activities of $5.1 million for the six months ended 31 December 2015. This was primarily due to the higher profit generated in the continuing operations, as compared to the prior period.

Net cash used in investing activities was $7.5 million, which was mainly due to the purchase of held-tomaturity investments and fixed deposits placed with financial institutions with over three month tenures upon maturity. Net cash used in financing activities was $1.4 million, primarily due to dividend payout and repayment of bank loan.

There was a decrease in cash and cash equivalents of $3.8 million for the first six months ended 31 December 2015.

The Group closed the period with cash of $8.7 million and with bank borrowings of $1.3 million.

Commentary

The Group registered a profit of $3.4 million for the first six months ended 31 December 2015. This sixth consecutive positive quarterly performance was driven by the continuing operations which generated higher revenue and gross profit margin.The Group will continue to work towards profitability, and is optimistic of maintaining long term sustainability and growth.

The Group remains committed to optimizing its core competences, ongoing strategic cost management and productivity enhancement across the business segments. The Group will continue to seek for new areas of growth such as through partnership, mergers and acquisitions, or any structure or business which will enhance shareholder returns.